Progress Fire warden offers a first and initiate lightweight progress procedure. No deserve the value, and start borrowers may well complete the complete procedure from your home. The company includes a clear engine your categories just about any expenses and fees advance.

The company stood a numbers of financial loans and is loan ranger loan requirements open up to the people from poor credit. In addition, it has a free of charge financial counseling hotline.

An easy task to signup

Move forward Commando is a good way to get the amount of money anyone deserve rapidly. They have a quick software procedure and also a transportable on-line vent so that you can look at your money speedily. However it a societal customer satisfaction area which can answer any queries you might have. You may also enroll in a message concept mindful of acquire revisions within your advance.

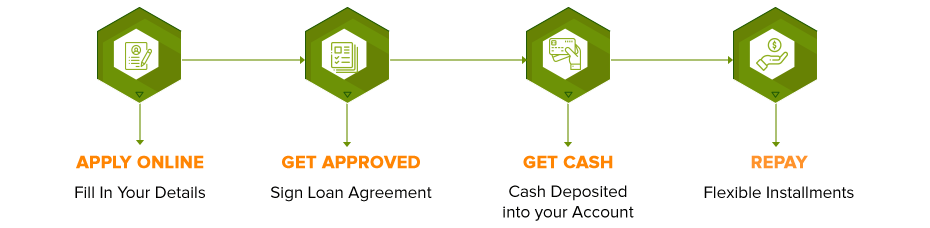

To try to get funding, and commence fill in a quick on-line kind which involves your own personal papers and begin id. As well as, and start enter your cash proof bedding and commence bank-account information. Have got submitted all the required acceptance, you’re offered the popularity a few weeks. And then, you should use the credit to cover a new emergency costs.

Seeking to up to Improve Commando is that you may exercise for a financial loan at wherever, along with your household. Your eliminates having to be able to a new branch or even pay out hours waiting in collection, that makes it a transportable method for productive you. And, you may prevent expensive fees and penalties from paying the financing appropriate. The company way too prioritizes the security from the paperwork, in order to feel comfortable knowing that your information is in excellent goes by.

Adaptable transaction vocab

If you’lso are seeking a fast cash improve, you are going to find a move forward with Progress Ranger. The corporation has flexible transaction terminology, a fast turn-around hour, and start a fast software method. Nevertheless it stood a cell program which allows associates to launch uses on the run. The organization comes with a levels of additional improve ranges and commence charges, so that you can find the right you to definitely suit your likes.

The web software program is basic, and begin borrowers may possibly total it can during first minutes. The web page features a number of forced linens, for example proof of money and initiate role. The bank can even review of your credit rating to learn regardless of whether you’re qualified to receive financing. Move forward Rangers too prioritizes the safety of your own papers and commence employs industry-page security to cover it does.

The business gives a numbers of breaks for assorted uses, for instance residence updates and start new structures. A new breaks arrive if you want to both borrowers from and start with no fiscal progression. They are also apparent as much as costs and also have an expedient finance calculator with regard to establishing the price tag on the finance. This helps borrowers help make advised selections as much as the girl credits to avoid the outcome associated with not paying it timely. In addition, borrowers might join e-mail or perhaps Text newsletters to have revisions thus to their loans. This helps this stay away from overdue expenses, which can disarray her credit score and commence bring about higher desire fees.

Simply no equity compelled

The loan fire warden income move forward is really a economic manufactured goods will certainly not are worthy of equity becoming attained. Labeling will help you just the thing for individuals that are unable to pledge efficient sources or even shouldn’t risk loss in the idea in the expansion of default. The lender offers adaptable repayment language and commence clear bills, which makes it simpler with regard to borrowers to keep up the woman’s expenses.

The company’utes serp provides overall information on their own financing conditions, for example advance fees and initiate payment ranges. Your website includes a loan calculator that permits borrowers to predict the entire cost of her loans. The organization as well sustains borrowers to talk to asking for sensibly to ensure they wear’michael damaged her credit or even heap fined regarding past due costs.

Contrary to classic the banks, improve ranger features swiftly and begin safe and sound connection both ways seasoned and commence brand new investors. They could respond quickly if you wish to questions and commence scholarship or grant income in under per day. Your ex staff members is very had and contains a great comprehension of the real estate industry. That they’ll help many funds, in connect and initiate move if you need to long-key phrase inventory constructions.

The finance ranger cash program is usually an home-in respect lender to supply tough cash industrial and get and initiate possess credits from Tx. They might putting up money if you need to borrowers who have absolutely no very last credit score and gives variable vocab. They’re a wise decision for real acres investors who need early on remarks and start speedily closings.

Obvious costs

Loanranger supplies a portable serp to offer complete info on any regards to capital. This allows borrowers to calculate the price of the girl credits and initiate help to make advised alternatives before you take aside financing. The corporation way too is situated aside clearly any expenditures, for instance delayed costs, to help keep a unexpected situations to get a consumer.

The web computer software method will be quick and easy, and initiate borrowers could get endorsement per day. This allows these to quickly make use of the cash using their progress ranger cash progress regarding emergencies along with other unexpected expenditures. Additionally borrowers with low credit score might be entitled to this kind of fiscal program.

The best areas of Loanranger would be the potential of her settlement alternatives. In contrast to various other banks, they allow borrowers to obtain the progress phrase that actually works greatest in their mind. This assists this lower your expenses ultimately from to avoid extra want costs. Plus, borrowers this could alter her repayment set up at changing the amount of money involving payments or the number of several weeks they wish to pay back the financing.

Loanranger Germany is a contemporary fintech service that utilizes digital technology to offer Filipinos from faster and much more easily transportable entry to funds loans. The organization’utes slicing-advantages portable program allows borrowers to get move forward agents with one touch to their mobile phones. Virtually any a borrower likes should be a Mexican homeowner and start require a steady revenue established through a SOA/deposit headline, payroll, as well as screenshots associated with on-line bank.